Saving for retirement can be overwhelming.

It’s a big goal. It still feels far away. If you’ve been busy building a business, paying off student loans, and starting a family, you might not have been able to put much away for years so you feel behind, too.

Remember you aren’t alone, and there is ALWAYS something you can do to start or ramp up your retirement plan. These are my top 5 strategies for being behind on retirement:

Make the most of your savings using a tax advantage retirement account.

The US tax code is complicated, and it is an alphabet soup of types of retirement accounts. But there are two main groups, and you take advantage of them to save more. There are employer sponsored retirement accounts, like 401(k)s, 403(b)s, and TSPs. Check in with your employer to see what type of retirement account you have, and also see if your employer will contribute for you with a match on your behalf. These accounts are a way to get money automatically deducted from your paycheck, and you’ll save on taxes too.

If you are a business owner, you’ll have to set up the account yourself, but with the extra work comes the ability to really customize your business retirement plan to suit your needs.

Even if you don’t have access to a work retirement plan, all of us can put money into an Individual Retirement Account or IRA.

Make a plan of how you’ll put away extra money.

Think through your current income and expenses and come up with a plan for how you’ll put away some extra money.

Are there any expenses you feel like aren’t worth it? Increase your retirement contribution by that amount.

A great time to increase your savings is when you get a raise. Put half the raise into a retirement account, and let the other half go towards increased living expenses or towards something fun.

Set up an automatic transfer from your bank account to your retirement account every month. If you have a plan – and you automate it – you’ll be much more likely to stick with it

Invest to grow your money.

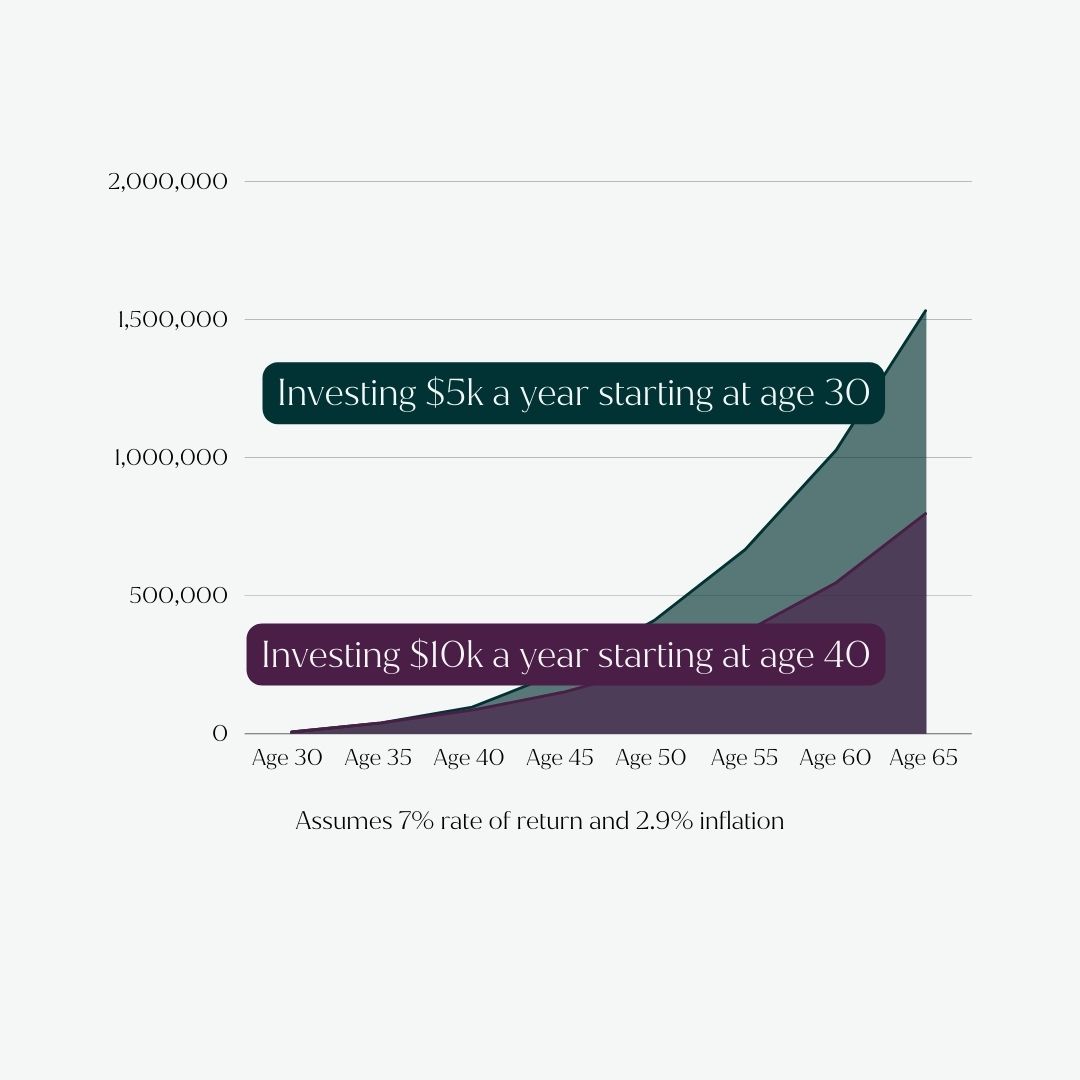

When saving for a big, far away goal like retirement, it’s not enough to save. You’ll want to invest the money so your money has a chance to make money for you.

There are a wide array of investments out there, but as a beginner, you can look into target date funds and index funds. These types of investments are diversified, meaning they buy a little bit of lots of different stocks and bonds. This means you aren’t putting your retirement all in on one stock.

Don’t take so much risk that you wipe out when you don’t have time to lose.

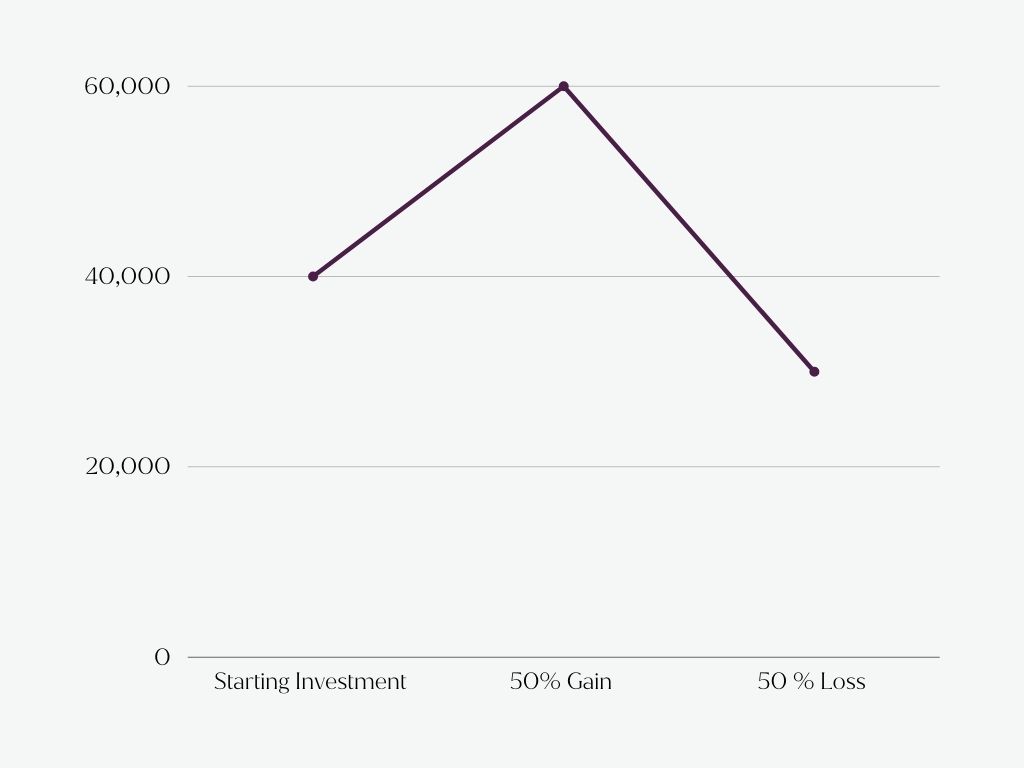

The closer you get to retirement, the less time you have to make up for any downs in the market. This means that high risk, speculative investments like cryptocurrency should only be a small portion of your investment portfolio, if you have any at all.

You’ll also want to consider turning down the dial on higher risk, higher reward investments like stocks, and consider adding more lower risk, lower reward investments like bonds and real estate.

If you gain 50% and then lose 50% – you actually end up with less money than when you started. Mitigating any potential losses by having a mixture of asset classes like stocks, bonds, and real estate is essential, especially the closer you are to retirement.

START! Even if it is $25/month!

The hands-down best thing you can do to save for retirement is start doing it. Whatever age you are, however much money you make, you are going to need a retirement fund. Start small and create the habit! Your money will grow over time, and anything you save now can be a big help later.

Are you having trouble getting started? Reach out to us and we’d be happy to help you figure out what type of retirement account and what investment options are a good fit for you.